Want to understand what Polymarket is and how prediction markets work - without the hype?

Polymarket is the world's largest decentralized prediction market, where millions of users trade on real-world outcomes like elections, crypto prices, sports, and global events. In this complete beginner guide, you'll learn exactly how Polymarket works, how to read market probabilities, and how to use prediction markets safely.

Whether you're researching "what is Polymarket" or ready to explore live markets, this guide covers everything from basic concepts to placing your first trade, plus how to use Coinrithm's Prediction Markets page to discover thousands of active markets before you trade.

TL;DR

- Polymarket is a prediction market where you trade on real-world outcomes (elections, crypto prices, sports).

- Prices = probabilities: $0.70 means the market thinks there's a 70% chance of happening.

- Always read resolution rules before trading - they determine how markets settle.

- Use Coinrithm Prediction Markets to discover and research markets, then trade on Polymarket.

- Start small, focus on research, and never risk more than you can afford to lose.

Table of Contents

- What Is Polymarket

- What Are Prediction Markets

- How Polymarket Works

- How to Use Coinrithm for Prediction Markets

- How to Trade on Polymarket

- Polymarket vs Kalshi vs PredictIt

- Is Polymarket Safe and Legit

- Polymarket Fees and Costs

- Common Beginner Mistakes

- Why Use Coinrithm for Prediction Markets

- Frequently Asked Questions

- Conclusion

What Is Polymarket

Polymarket is a decentralized prediction market built on the Polygon blockchain where users buy and sell shares on real-world outcomes.

Instead of trading stocks or cryptocurrency, you trade on questions like:

- "What price will Bitcoin hit in January" (Crypto)

- "Who will Trump nominate as Fed Chair" (Politics)

- "Will the US strike Iran by June 30" (Geopolitics)

- "Who will win the English Premier League" (Sports)

Each outcome has a price between $0.00 and $1.00. The price reflects what the market collectively believes the probability is.

Simple example:

If "Bitcoin hits $95,000 in January" is trading at $0.85, the market believes there's approximately an 85% chance it happens. If you think the real probability is higher, you buy. If lower, you sell or buy the opposite outcome.

When the event resolves, winning shares pay $1.00 each. Losing shares become worthless ($0.00).

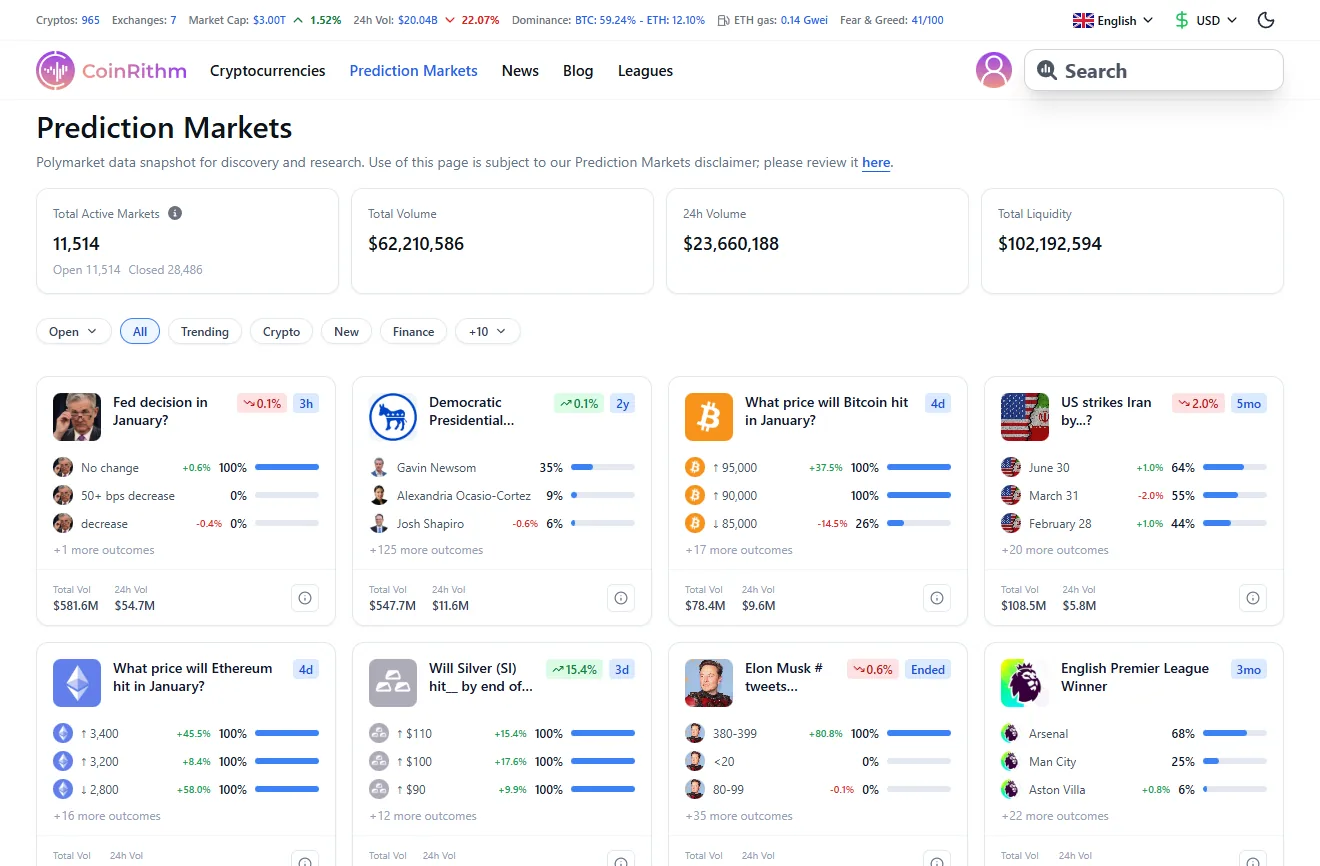

Prediction Markets Snapshot (Coinrithm, January 27, 2026)

These live stats come from Coinrithm's Prediction Markets page, which aggregates Polymarket data for discovery and research.

| Metric | Value |

|---|---|

| Total Active Markets | 11,514 |

| Total Volume | $62,210,586 |

| 24h Volume | $23,660,188 |

| Total Liquidity | $102,192,594 |

| Monthly Users | 13M+ (reported) |

| Categories | Politics, Crypto, Sports, Finance, Entertainment |

Why Polymarket Matters in 2026

Prediction markets have gone mainstream:

- Google Finance now displays Polymarket and Kalshi data directly in search results

- Monthly traffic exceeded 13.5 million visits (Semrush data, November 2025)

- Cumulative volume surpassed $40 billion in 2025

- 2026 events like FIFA World Cup and US Midterms are driving massive interest

Prediction markets are becoming the go-to source for real-time sentiment on elections, Fed decisions, crypto prices, and major world events.

What Are Prediction Markets?

Prediction markets are trading platforms where people buy and sell contracts based on future event outcomes.

Think of it as a stock market for probabilities:

- Each "stock" represents a possible outcome

- The price reflects crowd consensus on probability

- Prices change as new information arrives

- When the event happens, correct outcomes pay out $1.00

Example:

Market question: "Will the Fed cut rates in January"

- Yes shares: $0.15 (market thinks 15% chance)

- No shares: $0.85 (market thinks 85% chance)

If you buy 100 Yes shares at $0.15 ($15 total) and the Fed cuts rates, you receive $100. That's $85 profit.

If they don't cut, your Yes shares become worthless. You lose $15.

How Prediction Markets Differ from Betting

| Aspect | Prediction Markets | Traditional Betting |

|---|---|---|

| Purpose | Information discovery & forecasting | Entertainment |

| Pricing | Set by traders (peer-to-peer) | Set by bookmaker |

| House Edge | None | Built-in advantage |

| Primary Use | Research, hedging, sentiment | Gambling |

| Accuracy | Often beats polls & experts | N/A |

Prediction markets aggregate information from thousands of participants with money at stake. This creates powerful forecasting signals that often outperform traditional polls - especially for elections and economic events.

Why Prediction Markets Are Often Accurate

When real money is at stake:

- Traders do better research before committing

- Mispriced outcomes get corrected (arbitrage)

- Information spreads faster than polls or pundits

Important: "Often accurate" doesn't mean "always right." Markets can be wrong, manipulated, or uncertain. Treat prices as probability estimates, not guarantees.

How Polymarket Works

Here's the complete flow:

1. Market Creation - Someone creates a market with a specific question, outcomes, resolution rules, and end date.

2. Trading Begins - Traders buy/sell outcome shares. Prices move as sentiment shifts.

3. Information Arrives - News and events cause traders to update positions. Prices react in real-time.

4. Market Resolves - At the designated time, the market settles according to official data sources defined in the rules.

5. Payouts - Winning shares pay $1.00. Losing shares pay $0.00.

Outcomes and Prices Explained

Binary Markets (Yes/No):

Most simple markets have two outcomes:

- Yes = Event will happen

- No = Event won't happen

Yes + No prices sum to approximately $1.00 (minus spread).

Multi-Outcome Markets:

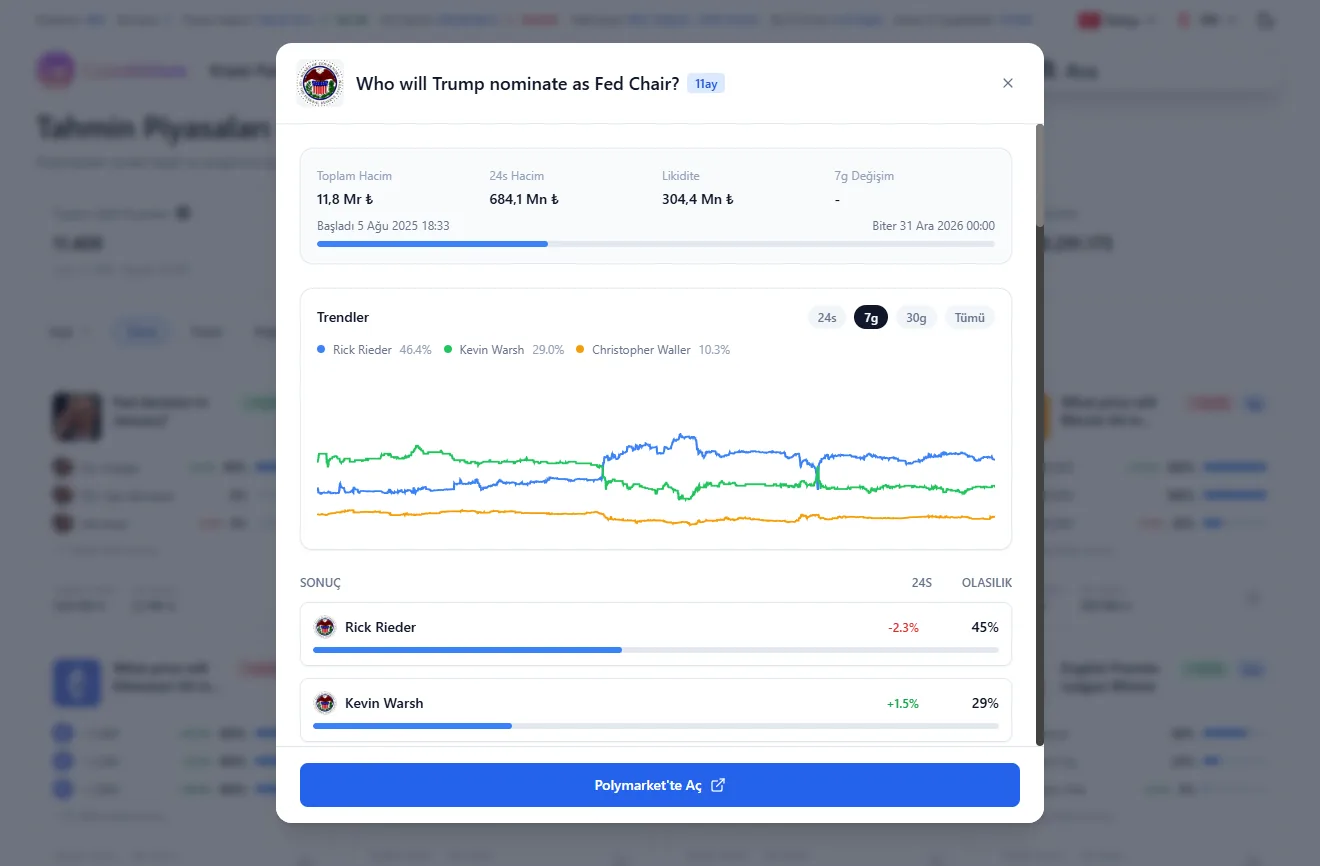

Some markets have multiple outcomes. Example from Coinrithm Prediction Markets:

"Who will Trump nominate as Fed Chair"

- Rick Rieder: 45%

- Kevin Warsh: 29%

- Christopher Waller: 9%

- Individual Y: 0%

- Individual Z: 0%

- Other: Various %

All outcome prices sum to approximately $1.00.

What Probability Really Means

Critical concept: Prices are probabilities, not certainties.

If an outcome is priced at $0.80:

- Market believes ~80% chance it happens

- Still ~20% chance it doesn't

- The market could be wrong

Prices reflect current consensus based on available information. They change constantly as:

- New information emerges

- Traders update beliefs

- Large buyers/sellers enter

Never treat high probability as guaranteed. Even 95% outcomes fail 1 in 20 times.

Understanding Resolution Rules

Resolution rules are the most important thing to read before trading.

Every market defines:

- What counts as valid outcome (exact definitions)

- Data source for determining result

- Resolution date/time

- Edge cases (unusual scenarios)

Real Example from Coinrithm:

Market: "Who will Trump nominate as Fed Chair"

Rules:

This market will resolve according to the next individual Donald Trump, as President of the United States, formally nominates to be Chair of the Federal Reserve by December 31, 2026, 11:59 PM ET.

Formal nominations are defined as the submission of a nomination message to the U.S. Senate.

Acting or interim appointments will not count unless the individual is formally nominated to be Chair of the Federal Reserve by submission of a nomination message to the U.S. Senate.

The primary resolution source for this market will be official information from the U.S. Senate (see: https://www.senate.gov/legislative/nominations_new.htm).

Notice how specific:

- Must be formal nomination (not announcement)

- Must go to U.S. Senate

- Acting appointments don't count

- Resolution source: Official Senate records

Always read the rules. Many beginners lose money assuming how markets resolve instead of reading actual rules.

Market Categories

Polymarket covers many categories:

| Category | Example Markets |

|---|---|

| Politics | Elections, nominations, policy decisions |

| Crypto | Bitcoin price targets, ETH milestones, regulations |

| Finance | Fed decisions, interest rates, economic indicators |

| Sports | Championship winners, match outcomes |

| Entertainment | Award shows, media events |

| Geopolitics | International relations, conflicts |

| Science & Tech | Product launches, AI milestones |

How to Use Coinrithm for Prediction Markets

Coinrithm's Prediction Markets page is designed for discovery and research. Browse all markets in one place, filter by category, compare outcomes, then open trades on Polymarket when ready.

Step 1: Visit the Prediction Markets Page

Go to coinrithm.com/en/prediction-markets.

What you'll see at the top:

- Total Active Markets - Open markets (11,514)

- Total Volume - All-time volume ($62,210,586)

- 24h Volume - Last 24 hours ($23,660,188)

- Total Liquidity - Available liquidity ($102,192,594)

Coinrithm Prediction Markets overview with live stats and category filters.

Step 2: Browse and Filter Markets

Use filter tabs:

- Open - Currently active markets

- All - All markets including closed

- Trending - Rising activity

- Crypto - Bitcoin, Ethereum, crypto markets

- New - Recently created

- Finance - Fed decisions, rates, economic events

- +10 more - Politics, Sports, Entertainment, etc.

Market cards show:

- Market question/title

- Top outcomes with percentages

- 24h change (green/red)

- Time remaining

- Total volume and 24h volume

Step 3: View Market Details

Click any market card to open the detail modal.

Modal sections:

| Section | Information |

|---|---|

| Header | Question, time remaining, 24h change |

| Stats | Total Volume, 24h Volume, Liquidity, 7d Change |

| Timeline | Start -> End date with progress |

| Trends Chart | Price history (24h, 7d, 30d, All) |

| Outcomes | All outcomes with probability and 24h change |

| Rules | Resolution rules and data sources |

Example - "US strikes Iran by..." market:

- Total Volume: $108.5M

- 24h Volume: $5.8M

- Liquidity: $851.5K

- 7d Change: -9.0%

- Started: Dec 22, 2025

- Ends: Jun 30, 2026 (1:00 AM)

Outcomes (sample):

- June 30: 64%

- March 31: 55%

- February 28: 44%

- January 26: 0%

- January 25: 0%

- January 24: 0%

Market detail modal with volume stats, trends chart (24h/7d/30d), outcomes, and resolution rules.

Step 4: Read the Resolution Rules

Scroll down in modal to find Rules section (expand if collapsed).

Example - "US strikes Iran by..." rules:

This market will resolve to "Yes" if the US initiates a drone, missile, or air strike on Iranian soil or any official Iranian embassy or consulate between the time of this market's creation and the listed date (ET). Otherwise, this market will resolve to "No".

For the purposes of this market, a qualifying "strike" is defined as the use of aerial bombs, drones or missiles (including cruise or ballistic missiles) launched by US military forces that impact Iranian ground territory or any official Iranian embassy or consulate.

Missiles or drones which are intercepted and surface-to-air missile strikes will not be sufficient for a "Yes" resolution regardless of whether they land on Iranian territory or cause damage.

Actions such as artillery fire, small arms fire, FPV or ATGM strikes directly, ground incursions, naval shelling, cyberattacks, or other operations conducted by US ground operatives will not qualify.

The resolution source will be a consensus of credible reporting.

Notice the specificity:

- Defines exactly what counts as "strike"

- Excludes intercepted missiles

- Excludes ground operations and cyberattacks

- Specifies resolution source

This detail prevents disputes and helps you understand exactly what you're trading.

Step 5: Open on Polymarket

Click "Open on Polymarket" button at modal bottom.

This takes you directly to that market on Polymarket to:

- Connect wallet

- Buy/sell outcome shares

- Track positions

Coinrithm = Discovery. Polymarket = Trading.

How to Trade on Polymarket

Once you've found a market on Coinrithm and understand the rules, here's how to trade.

Creating a Polymarket Account

- Visit polymarket.com

- Click "Sign Up" or "Connect Wallet"

- Connect compatible wallet (MetaMask, Coinbase Wallet, etc.)

- Complete verification if required

Polymarket runs on Polygon (Ethereum layer-2), so you need a Polygon-compatible wallet.

Funding Your Account

Polymarket uses USDC (USD stablecoin) for trading.

To fund:

- Deposit USDC to your wallet on Polygon

- Or use Polymarket's deposit options (card, crypto transfer)

- Ensure enough for trades + gas fees

Start small. Deposit only what you're comfortable losing while learning.

Placing Your First Trade

- Find market - Search for the market you researched on Coinrithm

- Select outcome - Click outcome you want (e.g., "Yes" or specific candidate)

- Enter amount - Specify USDC amount

- Review - Check shares, price, potential payout

- Confirm - Approve transaction in wallet

Example trade:

- Market: "Bitcoin hits $95,000 in January"

- Outcome: Yes (currently $0.85)

- Spend: $100 USDC

- Receive: ~117 Yes shares

- If Yes wins: $117 (profit $17)

- If No wins: Lose $100

Tracking Your Positions

After trading:

- View positions in Polymarket portfolio

- Watch prices change with news

- Decide: hold to resolution or sell early

You can sell anytime before resolution. Take profits early or cut losses without waiting.

Polymarket vs Kalshi vs PredictIt

| Feature | Polymarket | Kalshi | PredictIt |

|---|---|---|---|

| Type | Decentralized (crypto) | Centralized (CFTC-regulated) | Centralized (CFTC-regulated) |

| Currency | USDC (Polygon) | USD | USD |

| US Access | Restricted | Yes | Yes |

| Markets | Politics, crypto, sports, all | Events, economics, weather | Primarily politics |

| Fees | ~2% on winnings | ~1% per contract | 10% profit + 5% withdrawal |

| Position Limits | None | $25,000/market | $850/market |

| KYC Required | Minimal | Yes | Yes |

| Best For | Crypto users, large positions | US residents, regulated | Small US political trades |

Which to choose:

- Polymarket - Best variety, lowest fees, crypto-native, no position limits

- Kalshi - Best for US residents wanting regulated, compliant access

- PredictIt - Best for small political trades in US (strict limits)

Is Polymarket Safe and Legit

One of the most common questions. Here's an honest assessment.

Security and Trust

Polymarket is legitimate with:

- Millions of monthly users

- Billions in cumulative volume

- Transparent on-chain settlement

- UMA oracle system for dispute resolution

However, no platform is 100% safe. Risks include:

- Smart contract vulnerabilities (rare but possible)

- Oracle failures (resolution disputes)

- Regulatory changes affecting access

- Market manipulation in low-liquidity markets

Legal Status by Region

| Region | Status |

|---|---|

| United States | Restricted (geo-blocked) |

| France | Blocked (ANJ order, Nov 2024) |

| Portugal | Blocked (Jan 2026) |

| Italy | Blocked |

| Germany | Accessible (legal gray area) |

| United Kingdom | Accessible |

| Turkey | Accessible |

| Brazil | Accessible (regulatory uncertainty) |

| Most of LATAM | Accessible |

Always check local laws before participating. Regulations change frequently.

Risk Factors

Before trading on any prediction market:

- Only use money you can afford to lose - Positions can go to zero

- Understand resolution rules - #1 beginner mistake is misunderstanding rules

- Check liquidity - Low liquidity = wider spreads, manipulation risk

- Verify access - Ensure Polymarket works in your region

- Secure your wallet - Use hardware wallets for large amounts

Polymarket Fees and Costs

Polymarket has low fees compared to alternatives:

| Fee Type | Amount |

|---|---|

| Trading Fee | ~2% on winnings |

| Gas Fees | Variable (Polygon cheap, usually <$0.01) |

| Deposit Fees | Depends on method |

| Withdrawal Fees | Depends on method |

| Spread | Varies by liquidity |

Tips to minimize costs:

- Trade liquid markets (tighter spreads)

- Use crypto deposits (cheaper than cards)

- Batch trades when possible

Common Beginner Mistakes

Learn from others:

1. Not Reading Resolution Rules

The #1 mistake. You assume you understand, but rules define something specific you didn't expect. Always read rules.

2. Confusing Probability with Certainty

90% probability still fails 10% of the time. Don't bet savings on "sure things."

3. Overtrading

Too many trades = higher fees, lower edge. Be selective.

4. Chasing Hype

Trending doesn't mean you have edge. Do your research.

5. Ignoring Liquidity

Thin markets have wide spreads and manipulation risk. Stick to liquid markets.

6. Emotional Trading

Don't revenge trade after losses. Stick to research.

7. Poor Position Sizing

Never risk more than 5-10% of portfolio on single market. Diversify.

8. Forgetting Fees

Small edges get eaten by fees. Ensure expected profit exceeds costs.

Why Use Coinrithm for Prediction Markets

You can go direct to Polymarket, but Coinrithm offers advantages:

| Feature | Coinrithm | Direct Polymarket |

|---|---|---|

| Aggregated View | All markets in one place | Must search/browse |

| Quick Filtering | Category, trend, volume filters | Limited filtering |

| Multi-Language | 8 languages | English-focused |

| Research First | Discovery tool, then trade | Designed for trading |

| No Wallet Needed | Browse freely | Need wallet for details |

| Combined Platform | Same place for crypto tracking, portfolio, mock trading | Separate from portfolio |

Use Coinrithm to:

- Discover interesting markets across categories

- Compare outcomes and trends

- Read resolution rules before committing

- Open on Polymarket when ready to trade

Related: Learn risk-free trading with our Complete Guide to Crypto Paper Trading.

Frequently Asked Questions

What is Polymarket in simple terms

Polymarket is a website where you trade on real-world outcomes. Instead of buying stocks, you buy shares in outcomes like "Will X happen" If you're right, you make money. If wrong, you lose your investment. It's like a stock market for predictions.

How does Polymarket work

Polymarket works by letting users buy and sell outcome shares. Prices range from $0.01 to $0.99 and represent probability. When the event resolves, winning shares pay $1.00, losing shares pay $0.00. An outcome priced at $0.70 means the market thinks there's a 70% chance it happens.

Is Polymarket gambling

Prediction markets share similarities with betting, but the core purpose differs. Prediction markets are designed for information discovery and forecasting - aggregating crowd wisdom to estimate probabilities. There's no house edge; you trade against other participants, not a bookmaker.

Can I lose all my money on Polymarket

Yes. If the outcome you bought resolves against you, your shares become worthless ($0.00). That's why position sizing and risk management matter. Never invest more than you can afford to lose.

Is Polymarket legal in the US

Polymarket has geo-restrictions for US users due to regulatory uncertainty. US residents have limited or no access. For regulated US prediction markets, consider Kalshi (CFTC-regulated) as an alternative.

Is Polymarket safe to use

Polymarket is a legitimate platform with millions of users and billions in volume. It uses transparent blockchain settlement and the UMA oracle for disputes. However, risks exist: smart contract bugs, oracle failures, regulatory changes, and manipulation in thin markets. Only use money you can afford to lose.

How accurate are prediction markets

Prediction markets often outperform polls and expert forecasts, especially for elections and economic events. However, they're not always right. Treat prices as probability estimates, not guarantees. A 90% probability still means 10% chance of being wrong.

Do I need cryptocurrency to use Polymarket

Yes. Polymarket operates on the Polygon blockchain and uses USDC (US dollar stablecoin) for trading. You need a crypto wallet (like MetaMask) with USDC on Polygon to participate.

What is the minimum amount to start on Polymarket

There's no official minimum, but considering gas fees and practical position sizes, $50-$100 USDC is reasonable for learning. Start small until you understand how everything works.

How do prediction market prices work

Prices range from $0.00 to $1.00 and represent estimated probability. A $0.65 price means ~65% chance that outcome happens. When resolved, winning shares pay $1.00, losing pay $0.00. If you buy at $0.65 and win, you profit $0.35 per share.

Can I sell my position before the market resolves

Yes. You can sell shares anytime before resolution. If price moved in your favor, take profits early. If against you, cut losses. You don't have to wait for the event to occur.

What's the difference between Polymarket and Kalshi

Polymarket is decentralized (crypto-based) with broader market variety but US restrictions. Kalshi is centralized and CFTC-regulated, accessible to US residents but with position limits ($25,000/market). Polymarket has lower fees (~2% vs ~1%) but Kalshi offers regulatory compliance for US users.

Conclusion

Polymarket and prediction markets offer a powerful way to see what crowds think about future events - and profit if you have better information.

What you now know:

- What Polymarket is and how prediction markets work

- How to read prices as probabilities

- Why resolution rules matter (and how to read them)

- How to use Coinrithm for discovery

- Basics of trading on Polymarket

- How to stay safe and avoid common mistakes

Your action plan:

- Start with Coinrithm - Browse Prediction Markets to discover what's active

- Pick a category - Focus on areas where you have knowledge (crypto, politics, sports)

- Read resolution rules - Always understand how markets settle before trading

- Start small - Begin with small amounts while learning

- Track and learn - Review trades and improve over time

Remember:

- Prediction markets are for research and forecasting, not guaranteed profits

- High probabilities can still be wrong

- Only trade what you can afford to lose

- Use Coinrithm for discovery, Polymarket for trading

Ready to explore prediction markets?

Browse Prediction Markets on Coinrithm - Discover thousands of active markets across politics, crypto, sports, and more.

Want to practice trading first? Try Coinrithm Mock Trade - Practice crypto trading risk-free with $50,000 virtual USDT.

Last Updated: January 27, 2026

Disclaimer: Prediction markets involve financial risk. This guide is for educational purposes only and is not financial, legal, or investment advice. Verify the legal status of prediction markets in your jurisdiction before participating. Only trade money you can afford to lose.